current location

current location

current location

Sale

Sale

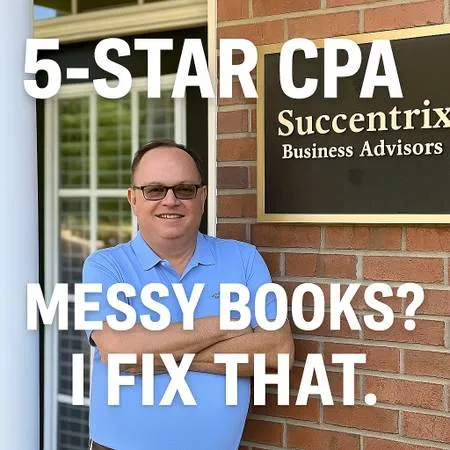

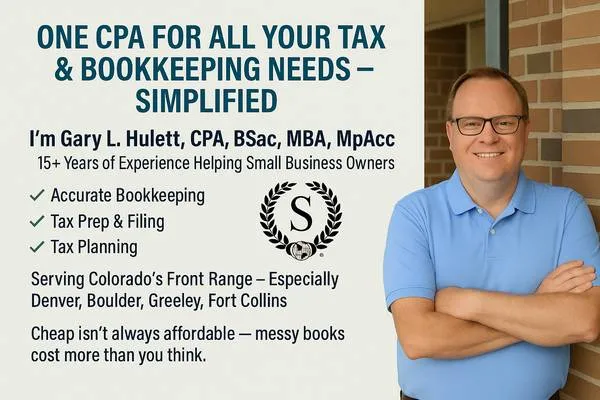

🛑 IRS Trouble? Don’t Fall for “Pennies on the Dollar” Myths — or Overpay a Tax Attorney Most IRS problems are financial, not criminal. You don’t need a high-priced tax attorney — and no, despite what those commercials tell you, most people don’t qualify to settle for “pennies on the dollar.” The IRS has strict rules and only a few qualify for deep discounts. That’s where I come in. I’m Gary L. Hulett, CPA, MBA, MPAcc — I help individuals and small businesses fix tax messes h 1 stly and affordably. No scare tactics. No false promises. No judgment. ✅ Late tax returns ✅ Back taxes ✅ IRS letters and notices ✅ Garnishments, levies, or liens ✅ Installment Agreements ✅ Penalty Abatement ✅ Offers in CompromiseOIC ✅ Currently Not CollectibleHardship Services & Pricing: • Late Return Filing: $300$800/yr • Installment Agreements: $750$1,250 • Penalty Abatement: $400$750 • OICIndividual: $2,500$4,000 • OICBusiness/Complex: $4,500$6,500 • Currently Not Collectible: $1,000$1,750 ✔️ Based in Brighton – Serving all of Colorado ✔️ 100 Virtual & Secure ✔️ Free 15-Minute Discovery Call Call: 720-392-1040 🌐Website:succentrixbrighton.com 📧Contact:succentrixbrighton.com/contact

Services

Services

Sale

Sale

🛑 IRS Trouble? Don’t Fall for “Pennies on the Dollar” Myths — or Overpay a Tax Attorney Most IRS problems are financial, not criminal. You don’t need a high-priced tax attorney — and no, despite what those commercials tell you, most people don’t qualify to settle for “pennies on the dollar.” The IRS has strict rules and only a few qualify for deep discounts. That’s where I come in. I’m Gary L. Hulett, CPA, MBA, MPAcc — I help individuals and small businesses fix tax messes h 1 stly and affordably. No scare tactics. No false promises. No judgment. ✅ Late tax returns ✅ Back taxes ✅ IRS letters and notices ✅ Garnishments, levies, or liens ✅ Installment Agreements ✅ Penalty Abatement ✅ Offers in CompromiseOIC ✅ Currently Not CollectibleHardship Services & Pricing: • Late Return Filing: $300$800/yr • Installment Agreements: $750$1,250 • Penalty Abatement: $400$750 • OICIndividual: $2,500$4,000 • OICBusiness/Complex: $4,500$6,500 • Currently Not Collectible: $1,000$1,750 ✔️ Based in Brighton – Serving all of Colorado ✔️ 100 Virtual & Secure ✔️ Free 15-Minute Discovery Call Call: 720-392-1040 🌐Website:succentrixbrighton.com 📧Contact:succentrixbrighton.com/contact

Services

Services

Sale

Sale

🛑 Read This First — Behind on Taxes or Owe the IRS? Years behind? IRS letters piling up? Don’t panic — but don’t ignore it either. 👨💼 I’m Gary L. Hulett, CPA, MBA, MPAcc — a small business CPA who helps individuals and entrepreneurs clean up past-due returns, fix IRS problems, and get back on track. 🔧 I Can Help With: • Late returns & extensions • Penalty abatement requests • IRS installment agreements • Bookkeeping cleanup • Tax planning to reduce future bills 💰 Flat-Rate Help: • Installment Agreements: $250$500 • Penalty Abatement: $300$600 • Prior-Year Returns: Priced same as currentbased on complexity 📘 Bookkeeping: $250$650 /mo • Categorized transactions • Reconciliations • CPA oversight 📉 Tax ReturnsDenver Metro: • W-2: $200$375 • Sole Prop: $650$800 • Rentals, S Corps, Partnerships: Based on complexity 💡 Why Choose a CPA? Because mistakes cost more than doing it right the first time. I bring IRS representation, real tax strategy, and support from some 1 who owns a business too. ✅ Audit protection ✅ Smarter tax savings ✅ Trusted, licensed expertise ✅ 100 Virtual | 🔐 Secure Portal | 📊 Personal CPA Attention 📞 720-392-1040 🌐 succentrixbrighton.com 📩 succentrixbrighton.com/contact 🆓 Free CPA Discovery Call — Book by 06/30 & Save 10 📍 Serving Denver Metro & Beyond — Fully Virtual

Services

Services

Sale

Sale

🚨 Bookkeeping + Tax Help to Keep the IRS Out of Your Life Self-employed? Small business owner? The IRS shouldn’t be your business partner. ✅ Full-service bookkeeping + expert CPA tax prep ✅ Stay compliant, reduce audit risk, and LEGALLY lower your tax bill ✅ Transparent pricing — no surprises or gimmicks Most small business owners mean well and try to save m 1 y on taxes and bookkeeping — but hiring the wrong help can cost you big time. Bad or no Bookkeeping, Missed deductions, IRS penalties, and notices can cost you time, m 1 y, and peace of mind. Don’t leave your hard-earned cash on the table or risk an audit. 📘 Bookkeeping: $250$650/mo Based on average monthly expenses Includes categorized transactions, bank recs, P&L, CPA review 📉 Tax Return PricingDenver Metro: • W-2: $200$375 • Itemized: $400$575 • Rentals: $575$700 • Sole Prop: $650$800 • S Corps / Partnerships: $1,450$1,750 💻 100 Virtual | Secure Portal | Personal CPA Attention 📞 Call: 720-392-1040 🌐 Website: succentrixbrighton.com 📩 Contact: succentrixbrighton.com/contact ⭐ Reviews: succentrixbrighton.com/our-reviews 🔥 Limited-Time Offer: NEW CLIENTS — Book by 06/30 & Save 10 Gary L. Hulett, CPA, MBA, MPAcc Succentrix Business Advisors – Serving Denver & Beyond

Services

Services

Sale

Sale

🚨 Bookkeeping + Tax Help to Keep the IRS Out of Your Life Self-employed? Small business owner? The IRS shouldn’t be your business partner. ✅ Full-service bookkeeping + expert CPA tax prep ✅ Stay compliant, reduce audit risk, and LEGALLY lower your tax bill ✅ Transparent pricing — no surprises or gimmicks Most small business owners mean well and try to save m 1 y on taxes and bookkeeping — but hiring the wrong help can cost you big time. Bad or no Bookkeeping, Missed deductions, IRS penalties, and notices can cost you time, m 1 y, and peace of mind. Don’t leave your hard-earned cash on the table or risk an audit. 📘 Bookkeeping: $250$650/mo Based on average monthly expenses Includes categorized transactions, bank recs, P&L, CPA review 📉 Tax Return PricingDenver Metro: • W-2: $200$375 • Itemized: $400$575 • Rentals: $575$700 • Sole Prop: $650$800 • S Corps / Partnerships: $1,450$1,750 💻 100 Virtual | Secure Portal | Personal CPA Attention 📞 Call: 720-392-1040 🌐 Website: succentrixbrighton.com 📩 Contact: succentrixbrighton.com/contact ⭐ Reviews: succentrixbrighton.com/our-reviews 🔥 Limited-Time Offer: NEW CLIENTS — Book by 06/30 & Save 10 Gary L. Hulett, CPA, MBA, MPAcc Succentrix Business Advisors – Serving Denver & Beyond

Services

Services

Sale

Sale

🌐 100 Online CO CPA — Licensed | Insured | Local 🎯 TAX PLANNING with ROI — or you don’t pay. If we can’t show tax savings that beat your investment, we won’t bill you. Guaranteed. 💼 Who We Help: Self-employed pros & small business owners who want to stay organized, compliant & profitable. 📈 Real Tax Plan Example: Small Biz Client with ~$60 K net income saved $5,149 first year Projected 5-year tax savings: $25,745 Plan investment: $2,575 → 2 X ROI Year 1, 10 X over 5 years 📊 Bookkeeping: • $250$650/mo based on average monthly expenses • Monthly reports, reconciliations, categorizations • FREE QuickBooks Online setup 📦 Tax + Bookkeeping Packages: • From $350/moavg 3 of revenue • Includes tax prep, bookkeeping & CPA tax planning 🧾 Business Tax Returns: • From $1,450 S Corps, LLCs, Sole Props, Partnerships • Bundle business + personal returns and save 📍 100 Virtual | Secure | Flat Rates | No Hourly Billing ✅ 15 yrs experience | Colorado CPA | QBO Specialist 📞 Gary L. Hulett, CPA – 720-392-1040 succentrixbrighton.com succentrixbrighton.com/contact succentrixbrighton.com/our-reviews

Services

Services

Sale

Sale

Mistakes on your taxes can lead to costly IRS notices, penalties, and missed deductions that mean you pay more than you should. Don’t leave your hard-earned m 1 y on the table or risk an audit! Hi, I’m Gary L. Hulett, CPA, MBA at Succentrix Business Advisors — a licensed CPA who specializes in protecting small business owners, self-employed, and W-2 filers from tax mistakes. ✔️ Expert review to catch missed deductions and credits ✔️ Accurate, IRS-compliant filings to avoid penalties ✔️ Help responding to IRS letters and auditsavailable as a separate paid service ✔️ Personalized tax planning to keep more m 1 y in your pocketoffered separately How It Works: 1. Submit your documents securely online 2. I review and prepare your return with care 3. You approve and I e-file directly with the IRS 4. You get peace of mind — no surprises Pricing Examples: W-2 Returns: $200$375 Itemized Returns: $400$575 Business Returns: $650$2,200 IRS Letter Help: From $250 separate service 💻 100 Virtual | 🔒 Secure Portal | 🎯 Transparent Pricing 📞 Call: 720-392-1040 🌐 Website: succentrixbrighton.com 📬 Contact Form: succentrixbrighton.com/contact ⭐ Reviews: succentrixbrighton.com/our-reviews 🕒 Limited Time Offer: NEW CLIENTS Book by 06/30 & Save 10

Services

Services

Sale

Sale

Mistakes on your taxes can lead to costly IRS notices, penalties, and missed deductions that mean you pay more than you should. Don’t leave your hard-earned m 1 y on the table or risk an audit! Hi, I’m Gary L. Hulett, CPA, MBA at Succentrix Business Advisors — a licensed CPA who specializes in protecting small business owners, self-employed, and W-2 filers from tax mistakes. ✔️ Expert review to catch missed deductions and credits ✔️ Accurate, IRS-compliant filings to avoid penalties ✔️ Help responding to IRS letters and auditsavailable as a separate paid service ✔️ Personalized tax planning to keep more m 1 y in your pocketoffered separately How It Works: 1. Submit your documents securely online 2. I review and prepare your return with care 3. You approve and I e-file directly with the IRS 4. You get peace of mind — no surprises Pricing Examples: W-2 Returns: $200$375 Itemized Returns: $400$575 Business Returns: $650$2,200 IRS Letter Help: From $250 separate service 💻 100 Virtual | 🔒 Secure Portal | 🎯 Transparent Pricing 📞 Call: 720-392-1040 🌐 Website: succentrixbrighton.com 📬 Contact Form: succentrixbrighton.com/contact ⭐ Reviews: succentrixbrighton.com/our-reviews 🕒 Limited Time Offer: NEW CLIENTS Book by 06/30 & Save 10

Services

Services

Sale

Sale

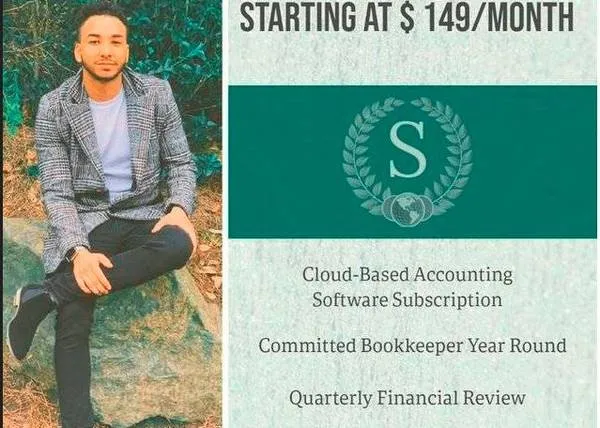

✅ Behind on your books? Behind for all of 2024 or already falling behind in 2025 We’ll take you from mess to success in just 60 days with CPA-led cleanup and tax prep. ✅ 60-Day Bookkeeping & Tax Cleanup From Mess to Success in Just 60 Days ✅ 60-Day Cleanup – Catch up, reconcile, and review your books fast 🧾 CPA Final Review – Clean financials + tax return filed 📊 Peace of Mind – Reports delivered, estimates planned, youre set 💼 Yearly Bronze Package – From $99/mo Ideal for small businesses & self-employed earning with low volume revenue and transactions. • Cloud-based accounting software included • Annual bookkeepingP&L + Balance Sheet • Regular CPA reviews • Annual tax prep 1040 + Schedule C + CO State return • Year-round access to your Succentrix Business Advisor 🔧 Optional Add-Ons: 🔹 S Corp Election + Setup Support 🔹 1099 Filing 🔹 Estimated Tax Service 🔹 Back Books Catch-Up 📊 Pricing Snapshot: ✅ Quarterly Bookkeeping with simple 1040 + Schedule C – from $149/mo ✅ Monthly Bookkeeping with simple 1040 + Schedule C – from $249/mo ✅ Monthly Bookkeeping with simple S Corp/Multi-Member LLC + simple 1040 – from $349/mo ✅ Standard 1040 Return – from $350 ✅ Complex 1040 Return – from $500 ✅ Schedule C – from $700 ✅ S-Corp / Partnership Returns – from $1400 ✅ QuickBooks Review + Catch-up Quote — Free 🎯 Flat pricing. No surprises. No call centers. Work directly with Gary L. Hulett, CPA – CO Licensed | MBA | MPAcc | QBO Specialist 📞 Free Discovery Call: 720-392-1040 Website: succentrixbrighton.com Reviews: succentrixbrighton.com/our-reviews Contact: succentrixbrighton.com/contact 📍 Serving Denver Metro & Virtual CO Clients 👍 Real Help from a Real CPA — No Outsourcing. No Surprises.

Services

Services

Sale

Sale

💼 Affordable CPA Bookkeeping & Tax | Plans from $149/mo | Virtual CO CPA Tired of overpaying or not getting enough help? You don’t need a big budget to get expert support. You just need a Colorado-licensed CPA who understands small business — and keeps your costs under control. 🔍 What You Actually Get: ✅ Clean, accurate booksyou’ll always know where you stand ✅ Year-round tax planning to avoid surprises ✅ Help saving m 1 y on taxes, not just filing ✅ Audit protection and penalty prevention ✅ Plain-English answers from some 1 who cares 📉 Full-Service CPA Support — Without the High Fees Most clients spend just 3 of their monthly salessame as your credit card fees. Except now that m 1 y actually helps grow your business and reduce your taxes. 💰 ROI Tip: What’s 3 worth if it saves you 510, or more, in taxes, penalties, or missed deductions? 📞 FREE CPA Discovery Call – No Pressure Let’s see if we’re a good fit. Contact: Gary L. Hulett, CPA, MBA, MPAcc Succentrix Business Advisors – Brighton, CO 📍 Virtual • Licensed • Insured • Serving all of Colorado 📞 Callno texts: 720-392-1040 🌐 succentrixbrighton.com 💼 BOOKKEEPING-ONLY PLANS START AT JUST $149/MO 🎯 Stop guessing. Start growing. Talk to a real CPA today. ⭐⭐⭐⭐⭐Read Our 5 Star Reviews: succentrixbrighton.com/our-reviews

Services

Services

Sale

Sale

📉 Overwhelmed by Bookkeeping? You’re Not Al 1. Solo biz? Self-employed? If your books are a messor n 1 xistent, youre probably: – Missing deductions – Stressing over taxes – Hoping the IRS doesn’t notice ✅ Stop guessing. Get clean, clear books — led by a CPA. We help small businesses get back on track with expert bookkeeping you can count on. ✅ Work with a CPA who handles both books and taxes — no guesswork. 💼 Flat Monthly Pricing Starts at $149/Month – CPA-managed QuickBooks Online bookkeeping – Quarterly reports – FREE QBO Subscription – Profit & Loss + Balance Sheet – Secure document portal – Clean financials = Lower tax prep fees *First month only $99 — includes setupcleanup billed separately if needed* 📍 100 Remote – Colorado-Based – Real Support from a Real CPA 🧾 Optional Tax Prep & Tax Reduction Planning Available 📞 Limited Spots – Grab Your Free Discovery Call Now No pressure, just real help. 👉 Callno texts: 720-392-1040 👉 Visit: succentrixbrighton.com * Save 33 OFF any SOLO Bookkeeping plan

Services

Services

Sale

Sale

📉 DIY Bookkeeping? Go Ahead… Fool/Around/Find/Out.Affordable CPA – All of Colorado, 100 Remote Thinking of doing your own books or taxes to save a few bucks? You could... but you might: 😰 Miss big deductions 📉 Overpay the IRS ⏳ Waste weekends in QuickBooks 🧾 Still end up with a mess come tax time 👋 I’m Gary L. Hulett, CPA, MBA | Succentrix Business Advisors – Brighton, CO Licensed CPA offering remote bookkeeping + tax help for small business owners & the self-employed. Most DIYers with under $200 K in revenue spend 820 hours/month wrestling their books. At even $50/hour, that’s $400$1,000/month in lost time — and that’s if nothing goes wrong. 💼 Here’s what you get starting at just $149/month: ✅ CPA-reviewed monthly bookkeeping ✅ FREE QuickBooks Online subscription ✅ Setup + bank feed connection included ✅ Tax-ready financials ✅ Access to Optional and discounted CPA tax prep & planning and payroll services ✅ 100 remote, secure support If you’re a solo operator grossing under $200 K/year, get clean, CPA-reviewed books for as little as $149/month — flat fee, no surprises. 📞 FREE CPA Discovery Call – No Pressure, Just Real Help 👉 CALL NOWNo Texts: 720-392-1040 👉 Visit: succentrixbrighton.com 📍 Based in Brighton – Serving ALL of Colorado Remotely 🚫 Don’t learn the hard way. ✅ Clean books, less stress, and smarter tax savings with a licensed CPA.

Services

Services